Are you on the journey to register your business in Indonesia? You’re in the right place!

Navigating the registration process as a foreigner in a new country might seem like a daunting task, but fear not – we are here to help you.

Here, we will walk you through the requirements, process, and essential tips for a smooth entry into Indonesia’s dynamic business landscape.

Table of Contents

Types of Business Entities in Indonesia

Choosing the right type of business entity is crucial, not only to comply with local regulations but also to protect personal assets. There are numerous business entity options available in Indonesia based on specific needs and preferences:

PT Local

PT (Perseroan Terbatas) is a limited liability company established and owned by locals (individuals, companies, or foundations).

A small company (Perorangan/individual) with IDR 5 billion maximum capital can have only one local shareholder, who also acts as the director. A company with IDR 50 million to unlimited capital must have two minimum local shareholders. Plus, have one minimum commissioner and director.

Even if you are a foreigner, you can still be a company director for a local company. But, there are certain job positions where foreigners are restricted, such as human resources director.

Representative Office

If you plan on doing business market research before generating revenue in Indonesia, setting up a representative office is the route for you.

It is the fastest way to establish your foreign business entity in Indonesia with no capital required.

PT PMA

As a foreigner, if you want to be a shareholder or generate revenue in Indonesia, you should register your business as a PT PMA.

PT PMA (PT Penanaman Modal Asing) is usually known as a foreign-owned company. It is a limited liability company which allows foreign direct investment.

Besides taking control of your business, there are other benefits to PT PMA registration. It includes but not limited to:

- Starting operational preparations

- Getting work and stay permits for your foreign employees

- Purchasing assets under the company name

- Getting industry licenses

- Registering your products

Ownership of Foreign-Owned Company

In a significant shift due to the Indonesian Omnibus Law, the government has made most business classifications on the Indonesia Positive Investment List available for 100% foreign ownership.

The business classifications include sectors in the digital economy, energy, infrastructure, and tourism. Moreover, there are 46 business lines open with partial restrictions for foreign ownership and 51 lines that need partnership with cooperatives and MSMEs.

But, there are still sectors closed for foreign ownership. Be informed on the business line you are interested in, and let Sam Consulting guide you through the evolving landscape of business ownership in Indonesia.

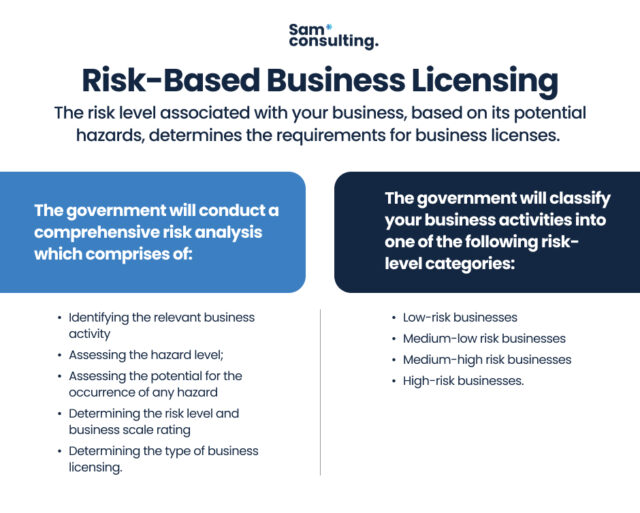

Risk-Based Business Licensing

In addition to relaxing restrictions on foreign investment, the Indonesian government has also introduced a Risk-Based Business Licensing procedure. The risk level associated with your business, based on its potential hazards, determines the requirements for business licenses.

The government will conduct a comprehensive risk analysis which comprises of:

- Identifying the relevant business activity

- Assessing the hazard level;

- Assessing the potential for the occurrence of any hazard

- Determining the risk level and business scale rating

- Determining the type of business licensing.

Afterward, the government will classify your business activities into one of the following risk-level categories.

- Low-risk businesses

- Medium-low risk businesses

- Medium-high risk businesses

- High-risk businesses.

This procedure benefits low and medium-risk businesses. Ultimately, if your business has a lower risk, you will have less complex licensing requirements.

Requirements for Foreign-Owned Company Registration

To start registering your foreign-owned company in Indonesia as a foreigner, prepare the requirements below:

Company’s Business Classification

Your business activities must match the classification listed in the Indonesian Standard Business Classifications and the Positive Investment List. This will help you know if your company can be 100% owned by foreigners, partially owned, or closed to foreigners.

Let us know your company’s business activities, and we will double-check to make sure your business classification matches your intentions.

Company Name

When naming your foreign-owned company, you can use English or non-Indonesian language. But, make sure that the name has not been used before and is not similar to other registered names unless allowed by the name owner.

Follow the pointers below to meet the standard:

- Contain at least three words with no obscene or misleading words

- Cannot have words that mean company or legal entity such as Ltd, Sdn, or Associate

- Written in Roman Alphabet with no numbers, special characters, or a mix of both.

Company Structure

Shareholders

There must be at least two shareholders with either a mix of local and foreign national or 100% foreign-owned. A public notary must approve its Articles of Association.

The share of a foreign-owned company is subject to the Positive Investment List of the Indonesia Investment Coordinating Board (BKPM), which varies depending on the business classification allowed.

Commissioners and Directors

The company must have one commissioner and one director minimum. The local or foreign commissioner oversees directors and ensures company activities align with its objectives and comply with the law and regulations.

One of the directors must hold an Indonesian tax card (NPWP). The Indonesia Investment Coordinating Board (BKPM) recommends having at least one local director. If all directors are foreigners, they must obtain a stay permit (KITAS or personal domicile letters) and work permits.

The general meeting of shareholders (RUPS), responsible for company management, elects the directors. Then, they can legally represent the company, sign contracts, and handle taxation documents.

Company Domicile and Capital

Domicile

Ensure your foreign-owned company has a verified location supported by a domicile letter. It should be an unrestricted area based on its business activities.

Capital

There is a minimum required capital of IDR 10 billion, excluding the investment value of land and buildings. The paid-up capital needed is 100% of the minimum required capital, which makes it IDR 10 billion or higher, depending on the business classification. The Capital is not required to be deposited during the process of establishing the company, however, it should be gradully inserted in the company account during the operation in Indonesia.

Steps to Register a Foreign-Owned Company in Indonesia

With proper assistance and preparations, registration can be straightforward and successful. Here are the steps you should take to make it happen:

Determine your appropriate legal structure and Main business activities

We can assist you in determining the ideal business structure and outlining shareholder proportions and roles. Our user-friendly company registration form ensures clarity in the process.

Reserve your company name

Inform us of your preferred company name in Indonesian, English, or both, and we will reserve it for you. If your first choice is unavailable, please provide two other options.

Sign registration and power of attorney forms

One of our specialists can handle all necessary procedures on your behalf. To do so, please sign the forms and provide a power of attorney.

We prepare all the necessary paperwork and register your company to OSS

Once you have e-signed the required documents we have prepared, we will collect and submit them to the Online Single Submission (OSS) and other relevant authorities for registration.

OSS confirms your new company

The duration of OSS processing may vary. Rest assured, we will deliver the company registration documents and activity registration certificate from the Ministry of Trade upon completion.

Open a corporate bank account in Indonesia

Sam Consulting collaborates with international and local banks for a hassle-free banking experience. We can either assist in preparing documents and arranging meetings or guide you through opening a bank account.

Obtain visas and residence permits

Before you and your foreign employees can begin working in your new company, the next step is to obtain the necessary visas and residency, which we are happy to assist with.

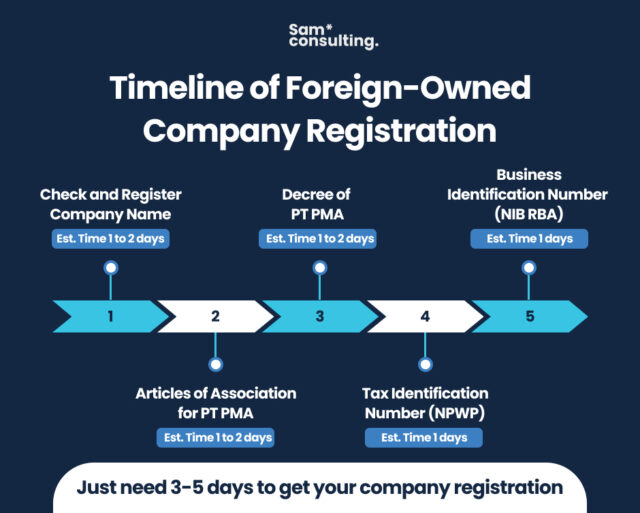

Timeline of Foreign-Owned Company Registration

Establishing a PT PMA in Indonesia involves obtaining essential licenses and papers. Here is a breakdown of the important documents and estimated timelines which nornal takes from 5 to 7 working days:

- Check and Register Company Name:

- Estimated Time: 1 to 2 days

- Articles of Association for PT PMA:

- Legalized by a public notary

- Estimated Time: 1 to 2 days

- Decree of PT PMA:

- By the Ministry of Law and Human Rights

- Estimated Time: 1 to 2 days

- Tax Identification Number (NPWP):

- From the Tax Office

- Estimated Time: 1 day

- Business Identification Number (NIB RBA):

- From the Tax Office

- Estimated Time: 1 day

It’s important to note that the mentioned licenses/documents provide a general guide, and specific sectors may require additional documents. The provided timeline does not account for potential registration rejections.

To ensure a seamless business registration process and tailored guidance, seeking legal advice before investing is highly recommended. Fortunately, we are here to help you navigate through the procedures effortlessly.

Taxation of Foreign-Owned Companies in Indonesia

It is mandatory to adhere to the taxation and regulations once you have obtained an Indonesian Tax Identification Number (NPWP). This includes compliance on corporate income tax (CIT), value-added tax (VIT), and personal income tax (PIT).

Note that the Indonesian Harmonization Tax Law has set the corporate income tax rate at 22 percent for the 2023 fiscal year in Indonesia.

In the first three years, you can choose to pay taxes as either 0.5% of total revenue or 22% of profit. After these three years and if your business makes 4.8 million or more in revenue, you must pay taxes based on 22% of the profit.

Fees for Cost-Effective Company Registration in Indonesia

Starting a foreign-owned company in Indonesia can be cost-effective starting from 2500$-3800$. By choosing professional legal services, you can save both time and money. Sam Consulting offers end-to-end support during the entire registration process, ensuring affordability without compromising quality.

Documents You Obtain After Opening a Company in Indonesia

After successfully registering your foreign-owned company, here are the documents you will obtain:

- Check & Register of Company Name

- Articles of Association for Foreign-Owned Company (AKTA PT PMA)

- Decree from the Ministry of Law and Human Rights (SK)

- Taxpayer Identification Number for Foreign-Owned Company (NPWP PMA)

- Tax Registration Letter (SKT Pajak)

- Business Identification Number through Risk-Based Approach (NIB RBA)

Remember, keeping these documents up-to-date is significant for smooth operations and compliance.

Tips for Staying Engaged in Indonesia

The business scene in Indonesia is thriving but demands cultural awareness and tact to stay engaged. Here are some essential tips to navigate this dynamic environment successfully.

Make strong local connections

Networking is not just a formality — it is the key to unlocking doors in Indonesia. Attend local events, join industry groups, and cultivate relationships. Indonesians value personal connections, and investing time in building trust can pave the way for fruitful collaborations.

Learn business culture differences

In Indonesia, cultural traditions and customs are essential in every aspect of life, from greetings to business meetings. Learning about Indonesian business etiquette, simple Bahasa Indonesia phrases, and appropriate gestures is vital to showing respect and genuine interest in the local way of life.

Ensure compliance after company establishment

After establishing your company, it is crucial to ensure compliance with local regulations. This includes preparing and submitting accurate investment activity reports (LKPM), fulfilling personal and company tax obligations by timely filing tax returns (SPT), and regularly renewing your business license, virtual office lease, etc.

Navigate legal waters with expert guidance

As a legal consulting firm, we understand the intricate legal landscape in Indonesia. Navigating local regulations can be complex, but with our expert guidance, you can ensure compliance and focus on building your business relationships without unnecessary hurdles.

Are you excited to put these insights into action? Our team of legal consultants is ready to assist you every step of the way. Click [here] to schedule a consultation, and let us take on this exciting journey together. Your seamless company registration journey begins with us.